Investment In Liberia? Write A Business Plan Before…

By J. Yanqui Zaza

Economic Editor

|

|---|

| Central Bank of Liberia - Sets Rules for Commencial Banks Without Makinig Planning A Requirement |

Many people, including Liberians, want to operate a business. Some people undertake the enterprise for pleasure, while others carry it out to support their living. However, many small and medium-size entrepreneurs always avoid the prerequisites, to write a detailed plan, according to a chief executive. He said public research shows that “…small business owners do not put time and research into a business plan meant to keep them from making a fatal mistake.” Wrongly, they conclude that their enthusiasm and creativity are the most important prerequisites; hence, they brush off advice to write a detailed plan, he added.

Further, he stated, “…Business plans aren’t like classroom busy work. A business plan helps entrepreneurs understand the market, where they fit in, how they compete and how many customers they need to succeed. Business plans spell out the relationships between operating expenses, prices, and profits, all essential information for an entrepreneur.”

1.4a: Commercial Banks' Loans By Economic Sector ‐ 2015

Thousands of Liberian Dollar

Please click here or the table to view a clearer version

|

|---|

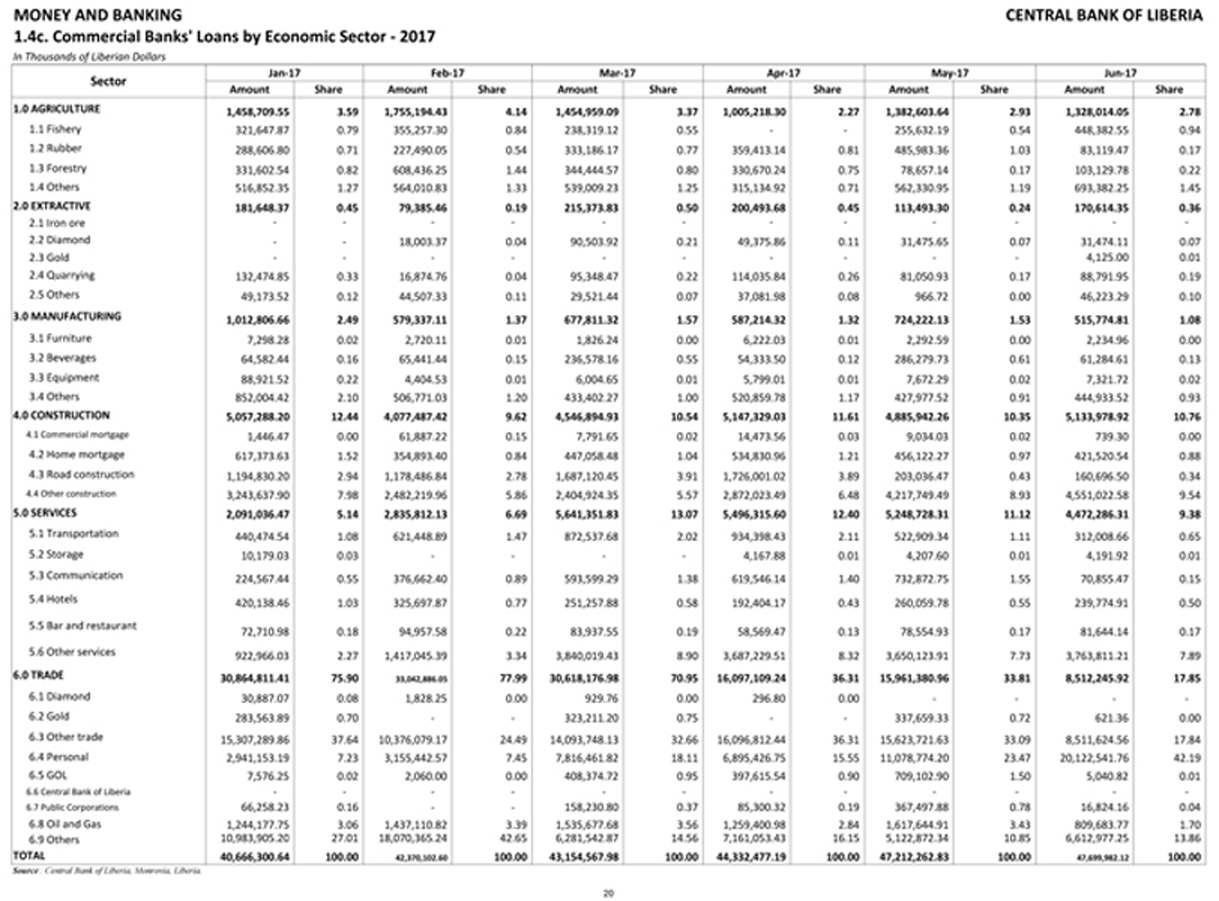

Above is page # 20 of the Financial Analysis of 2017-2019 prepared by the Central Bank of Liberia that an entrepreneur could begin with to develop a plan. The numbers on page depict the different sectors of businesses and the amounts borrowed from commercial banks. The borrowed amounts do indicate investment in a business sector and project the level of investment. For example, it shows that Liberians invested a minimal amount in manufacturing (2%), while they invested a significant amount (45%) in trade. Also, the minuscule amount borrowed to produce diamond and gold indicates that Liberia does not have a significant quantity of these precious resources or that local investors with detailed feasibility plan could be used to entice foreign partners to form a joint venture. For manufacturing, the limited borrowed amount indicates that the Liberia government pays the largest payroll.

Subsequently, when a significant number of the employable population depends on government meager wages, entrepreneurs might find it difficult to sell luxurious goods and, or services, even if they were to invest in manufacturing. By extension, money-lending industry (banking institution) might not survive since it must rely on revenue generated from cashing checks and serving customers of Western Union and MoneyGram, primarily, because manufacturing industries are limited or do not exist. Can service industry that many small entrepreneurs focus on survive? In the case of Liberia, an investigation might provide a clue.

From a layman’s view, many Liberian entrepreneurs have and, or are encountering the consequences of starting a business without a detailed plan. For instance, many school-aged-children, moving between vehicles, to sell anything, from three pairs of shoes, to a few sticks of cigarettes, to sell a few bundles of “Dead White-man Clothes (used clothing),” are not making ends meet. Unemployed residents, operating Mom and Pop “Beer Shops” in almost every corner of urban towns, are crushed by economic hardships. The story of business failures is not different for residents within rural villages who have abandoned food production and have opted to operate gold and, or diamond business.

The hotel industry in Liberia has limited financial information. So, in order to find out if real estate investors wrote plans for prestigious hotels located in Monrovia, let us look at one of the most luxurious hotels in Liberia, the Farmington Hotel. It is located less than 100 meters from Robert International Airports. Commenting on revenue, Mr. Richard Robaix, the general manager of the hotel, stated that management has to develop a plan to drag customers from Monrovia to the hotel order to increase the hotel’s occupancy rate from 20% to 40%. Another clue came from a financial consultant, who surmised that luxury hotels are relying on money laundering, an activity the government is struggling to curb, according to speakers at the Workshop held on April 17, through 19, 2018 in Monrovia.

Put aside the issue of using the illegal money to finance the 81 hotels in Liberia, how come the amount of loan allocated to the hotel is minuscule? Going back to the Chart above, the LD 118,000,000 loan allocated to restaurant versus LD 401,819,000 loan allocated to Hotels raise questions. Did the investors use their personal fortune or borrow loan from banks located outside of Liberia? Again, Mr. Robaix is now searching for a plan to drag customers from Monrovia to Farmington, all because investors failed to plan in the first place.

Are profits of money-lending institutions (commercial banks) the results of good business plans, or are the results of illegal activities? Central Bank reported in its 2017-2019 Report that commercial banks were strong, but their profits were not promising. Implicitly, the Central Bank stated that commercial banks did not generate significant revenue from money lending, its core business activities. Published documents show that they earned significant non-interest income. Okay, commercial banks do generate non-interest income (fees, commission, gains, etc.) from wiring and transferring money, managing clients’ assets, selling and buying clients’ stocks and bonds, etc., but these activities are secondary to money lending.

2014 AUDITED FINANCIAL STATEMENTS

REVENUE: |

E.BAN-LIB. |

GTB-LIB. |

LBDI-LIB. |

E.BAN-GH |

CITIBANK-USA |

INTEREST. INCOME |

LD1.1M |

LD317M |

LD599M |

CD790M |

$47B |

NON-INTEREST. INCOME |

LD1.2M |

LD444M |

LD484M |

CD330M |

$29B |

Let us review the Interest Income and Non-interest income as per the Chart above. Non-interest income earned by Liberian commercial Banks is high, while Eco bank of Ghana and Citibank of America earned low non-interest income. If I may ask, what are the assets or economic activities, which generated the Non-interest income since banks make interest income on customers’ deposits? This is because the banks’ Audited Financial Statements did not report any significant “Other Assets” and, or services from which they generated their “Non-interest Income.” Neither did any of the Central Bank’s Reports and the 2017-2019 Financial Analysis include any non-money lending activities (i.e., selling and buying stocks, managing clients’ assets, investigating financial activities etc.) in Liberia.

Leaving Monrovia aside, did investors write plans to operate bank branches within other Cities of the fourteen Counties? A business plan, if written, would have revealed the minimal existence of good borrowing clients such as manufacturing industry within those counties, according to the 2008-2011 County Development Agenda prepared by the then Ministry of Planning and Economic Affairs and Internal Affairs. These findings indicated that residents of the fourteen Counties do dependent on the government payroll. So, it did not come as a surprise in 2017 when commercial banks closed six branches in some of the fourteen Counties. In Zorzor District, Lofa County, for example, where Eco bank closed its branch, the logging company is the only big business.

Therefore, please review some facts (i.e., employed population, purchasing power, location, competition, suppliers, etc.) before you invest.

SOURCE:

CENTRAL BANK OF LIBERIA: https://cbl.org.lr/doc/strategicplan20172019.pdf

ECOBANK-LIBERIA- https://www.ecobank.com/upload/publication/20160608095901050RJ4WJ6Q3FE/2015061805402246076166CN3zWy2m2014.pdf

CITIBANK-USA: http://www.citi.com/citi/investor/data/k16a.pdf

LBDI: http://www.lbdi.net/Reports/LBDI-FINANCIAL-STATEMENTS-DECEMBER-31-2015.pdf

ECOBANK-GHANA:http://www.annualreportsghana.com/Home/Documents/GSE-Filings/2017/PR---063-EGH--FINANCIAL-STATEMENTS-FOR-YEAR-EN-(1).aspx

GTB-BANK:http://www.gtbanklr.com/images/pdf-folder/2014AuditedFinancialStatements.pdf